Subsidizing “Jewish Exceptionalism”

How U.S. Taxpayer Dollars, Policy Carve‑Outs, and Political Maneuvers Have Been Redirected Toward Jewish Organizations

The Tikvah Fund recently secured a $10.4 million federal grant under the Trump administration, ostensibly to fight “anti‑Semitism” and promote Talmud study.

Shortly after, the group released a 22‑minute video celebrating “Jewish exceptionalism” and denouncing what it called the “Tucker Carlson–AOC alliance.”

Eric Cohen, Tikvah’s President and CEO, declared that American Jews are the wealthiest Jewish community in history and insisted that Jewish youth must attend Jewish day schools rather than assimilate into American society. He emphasized that Israelis and American Jews are one people, united by the conviction that “being Jewish is the most important thing in the world, and in our own lives.”

That such rhetoric is now bankrolled by U.S. taxpayers is striking.

Tax Breaks Hidden in Legislation

Earlier this year, a special tax break for Jewish groups was slipped into Trump’s “Big Beautiful Bill” (BBB). Though the Senate parliamentarian initially struck it down, alongside unrelated provisions like ending the silencer ban, Senator Ted Cruz retooled the measure to ensure its return.

Other conservative priorities were discarded without resistance, but the GOP went to bat for this Jewish tax carve‑out.

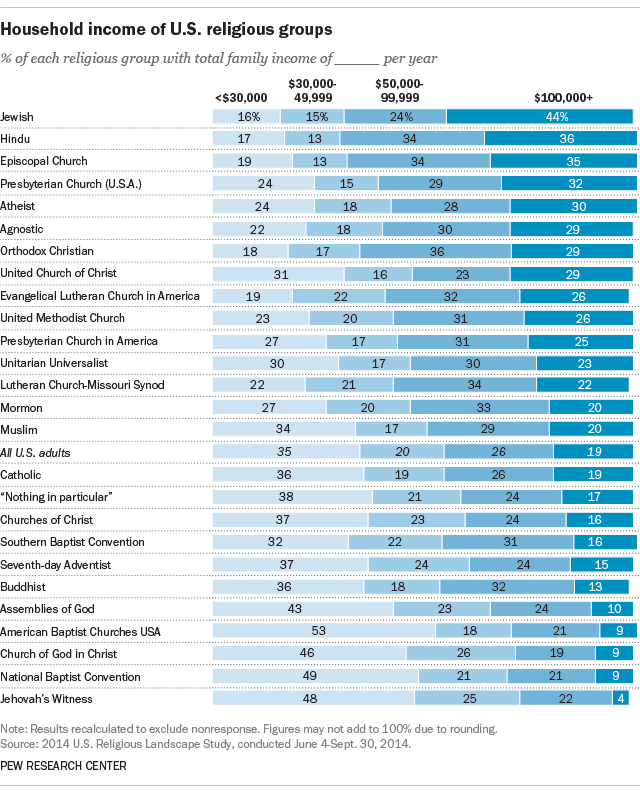

Minority Status for the Wealthiest Group

Even before Trump formally took office, officials advanced a policy granting “minority” status to Jewish‑owned businesses. Despite Jewish Americans having the highest incomes of any ethno‑religious group in the country, the Department of Commerce approved eligibility for billions in benefits originally intended for struggling minorities.

Critics described the move as affirmative action for the richest community in America.

One advocate even claimed:

We’re the biggest small minority in America and we had no voice, we had no eligibility to access our taxpayers’ dollars as the biggest minority and the biggest oppressed people!

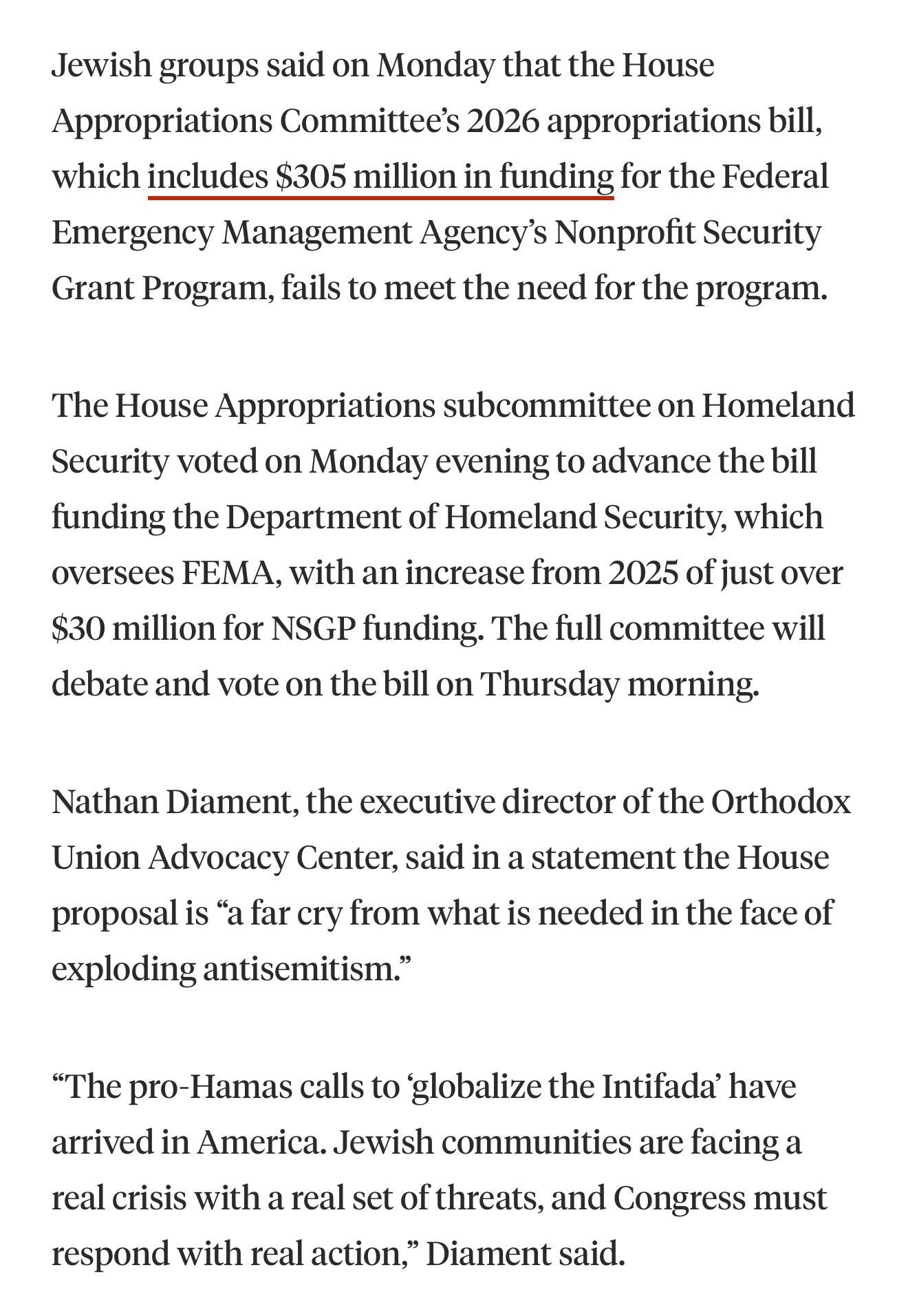

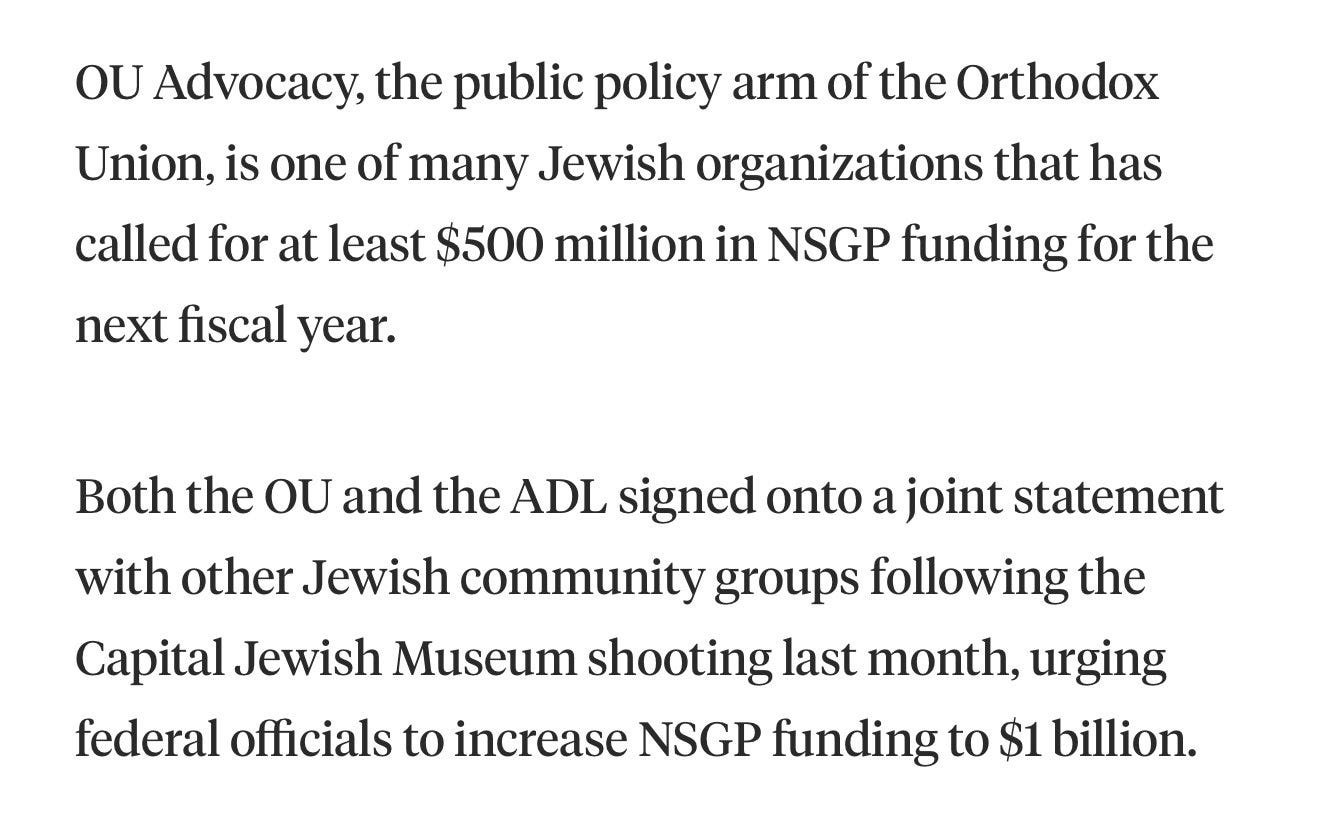

Security Grants: A Monopoly on Funding

Jewish organizations received 100% of the first disbursement of the 2024 Nonprofit Security Grant Program (NSGP). Historically, they have taken 94% of all NSGP funds.

House Republicans proposed $305 million for FY 2026, a $30 million increase, but were accused of “downplaying the threat from rising antisemitism.” Jewish groups, however, insist that at least $500 million is necessary, with some demanding $1 billion.

Philanthropy Recalibrated

In May, Jewish day schools were declared the top communal priority. By July, the tax break supporting them was passed and signed into law.

At the “State of World Jewry Address” in New York City, Dan Senor urged wealthy Jewish donors to stop funding non‑Jewish causes and redirect their philanthropy inward.

Jews are disproportionately represented on every list of prominent philanthropists. The Talmud was right.

He lamented that the majority of Jewish philanthropic dollars currently go to non‑Jewish causes and called for a “recalibration in favor of our community’s needs,” a message that drew thunderous applause.

Historical Context

Daniel Samuel Senor, a key neoconservative voice during the Bush years, was instrumental in selling the Iraq War to the American public. His influence highlights the enduring role of neocon priorities in U.S. foreign policy.

Pat Buchanan, meanwhile, was accused of anti‑Semitism and politically marginalized for suggesting that neoconservatives like Senor held dual loyalties.

The Chosen People practice blatant racism and exceptionalism, yet play eternal victims, manipulating and gaslighting their way into an ever greater share of taxpayer dollars and subsidies. Any word of complaint is slapped down as antisemitic. Surely this behavior is the greatest source of resentment and antisemitism. Perhaps those who endlessly bemoan antisemitism whilst gaslighting and manipulating the lions share of benefits should look in the mirror where the causes will stare them in the face.

I had to watch and listen over and over again, not because it is a novelty to be gaslit, but because I still can't wrap my head around the level of bullshit, victimhood and sheer arrogance.

Never before have I needed to take blood pressure meds, I am naturally on the low blood pressure side, but whenever these fuckers come on my body automatically freaks out.

And it doesn't have anything to do with them being Jewish, although most of them are certainly not semites.

They even appropriated that word solely for themselves. Shocker.

Whoever buys that crap, you are brainwashed and/ or stupid.

I hate Zionists, Rapists, Colonialists, Murderers and Terrorists and liars, not the Jewish faith.

How many times to we need to educate Zionists themselves that this is a secular movement? Have they re-writting their stories so many times that they can't keep up with the lies?

So today's topic is Make America Great For Jews ( Again?).

Yup, they have it real hard and difficult.

Fuck you and your Fuckery.

I feel bad for your children who grow up brainwashed.